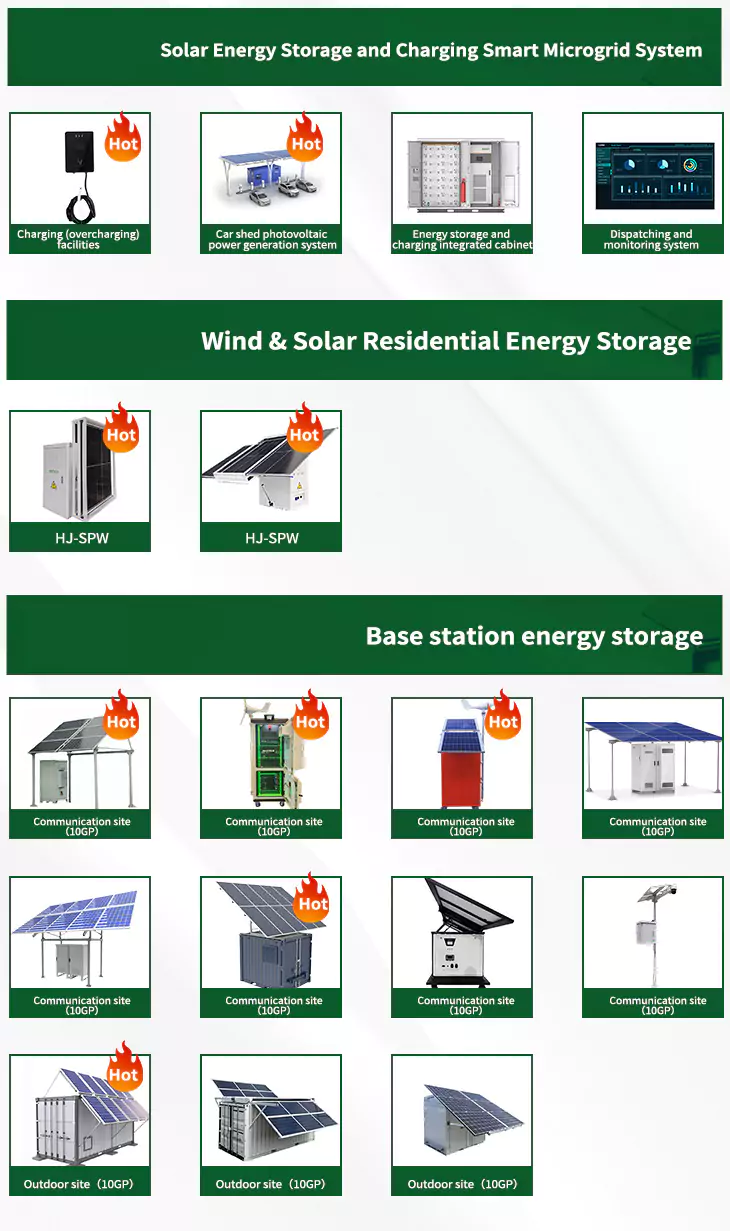

About Battery energy storage commercial profit analysis

As the photovoltaic (PV) industry continues to evolve, advancements in Battery energy storage commercial profit analysis have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient Battery energy storage commercial profit analysis for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Battery energy storage commercial profit analysis featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

6 FAQs about [Battery energy storage commercial profit analysis]

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Do energy storage systems generate revenue?

Energy storage systems can generate revenue, or system value, through both discharging and charging of electricity; however, at this time our data do not distinguish between battery charging that generates system value or revenue and energy consumption that is simply part of the cost of operating the battery.

What is a battery energy storage value chain?

In the U.S. market, the value chain is characterized by equipment suppliers, battery energy storage manufacturers, and end-use markets. Battery energy storage system utilizes batteries, module packs, connectors, cables, and bus bars as a part of the manufacturing process. Batteries form a major key component of battery energy storage systems.

Is energy storage a profitable investment?

profitability of energy storage. eagerly requests technologies providing flexibility. Energy storage can provide such flexibility and is attract ing increasing attention in terms of growing deployment and policy support. Profitability profitability of individual opportunities are contradicting. models for investment in energy storage.

Do battery energy storage systems improve the reliability of the grid?

Such operational challenges are minimized by the incorporation of the energy storage system, which plays an important role in improving the stability and the reliability of the grid. This study provides the review of the state-of-the-art in the literature on the economic analysis of battery energy storage systems.

Why are battery energy storage systems becoming more popular?

In Europe, the incentive stems from an energy crisis. In the United States, it comes courtesy of the Inflation Reduction Act, a 2022 law that allocates $370 billion to clean-energy investments. These developments are propelling the market for battery energy storage systems (BESS).

Related Contents

- Fiji energy storage battery profit analysis

- Battery energy storage safety profit analysis

- China s energy storage battery profit analysis

- Profit analysis of energy storage battery core

- Lg energy storage battery profit analysis

- Industrial energy storage battery profit analysis

- Energy storage bidding profit analysis

- Profit analysis of rare earth energy storage

- Battery energy storage field analysis report

- New energy storage huijue profit analysis

- Togo commercial energy storage battery system

- Profit analysis of large energy storage